straight life policy calculator

Trusteed For Over 100 Years. Updated last on January 31 2022.

Straight Line Depreciation Template Download Free Excel Template

No Medical Exam - Simple Application.

. Affordable Life Insurance From Prudential. Weve Designed Our Rates to Be Attractive Competitively Priced Compared to FEGLI. Gender Based on Policygenius.

Ad Life Insurance You Can Afford. Enter your policy payout amount and annual premium. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest.

Also known as whole life. A policy that provides continuous premiums that remain level for the policys life is known as a Straight Life Insurance Policy. From 15 A Month.

Apply Online Get Your Free Quote Today. Ad Use Our Calculator To Get a Free Estimate of The Value of Your Life Insurance Policy. Updated Oct 15 2021.

A Straight Life Annuity Retirement Plan also known as Straight Life Policy or Single Life Annuity is a retirement income product that pays a benefit until death but forgoes. See your rate and apply now. Ad Simple Easy-To-Follow Application Process Receive Your Quote In Minutes.

Rates starting at 11 a month. Top 2022 Life Insurance Plans Up to 70 off. A straight life insurance policy can also build cash value over time.

Dont Wait - Act Now. Term and Whole Life Insurance You Can Rely On. Ad Use Our Calculators to Help Determine How Competitive Coverage Is With WAEPA.

If youre at least 70 years old and own more than 100000 of life insurance you may qualify for a life settlement. Up to 100000 in coverage. Apply Online Get Your Free Quote Today.

Whole life insurance costs about 5 to 15 times more than a. Straight life policy calculator Thursday March 3 2022 Edit. Request Free Life Insurance Quote.

Straight Line Depreciation Formula Guide To Calculate Depreciation Co 250000 18000 8500 25000 301 500 Cn 20000. Get Your Free Quote. This phrase implies that premiums for the plan will remain constant and they will not rise or fall over the.

The cost of life insurance increases by 45 to 9 each year you put off buying coverage based on policies offered by Policygenius in 2022. Ad Exclusive term life insurance from New York Life. The life settlement calculator works in seven simple steps.

A straight life policy has a level premiumit wont change over the life of your policy. Straight life annuities do. Most of the life insurance premium calculators follow the below steps to calculate the premium of an insurance plan.

Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments. The cost of life insurance varies greatly from person to person and depends on several different factors. All life insurance calculators tools.

Ad A Policy Will Protect Provide For Your Loved Ones When You No Longer Can. The term straight refers to the whole life insurance policys premium structure. The prospective policy buyer should enter the following details.

Ad Life Insurance Coverage In 3 Easy Steps. Ad Simple Easy-To-Follow Application Process Receive Your Quote In Minutes. Most policy types are eligible including term life group whole universal.

Identify where you are prepared and where you might need to make some adjustments with a customized assessment of your financial plan. Life Insurance Provides Peace Of Mind Knowing Youre Protecting People You Love. To find the yearly depreciation amount using the double-declining method multiply the value of the asset at the beginning of the year by twice the straight line depreciation.

A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder. This is the amount to be paid by life insurance firms. A straight life annuity is a type of annuity in which the annuitant receives payments for as long as they live.

Affordable Life Insurance From Prudential. A straight life annuity policy may be bought over the course of the annuitants working life by making periodic payments into the annuity or it may be purchased with a single. Estimate The Value Of Your Life Insurance The Cash You Could Receive With Our Calculator.

Find Out Now What Your Life Insurance Policy Could Be Worth With Our Free Calculator. Life Insurance Premium Calculator. You may be able to borrow against the cash value but.

The straight life annuity does not have an end date or time and usually pays out.

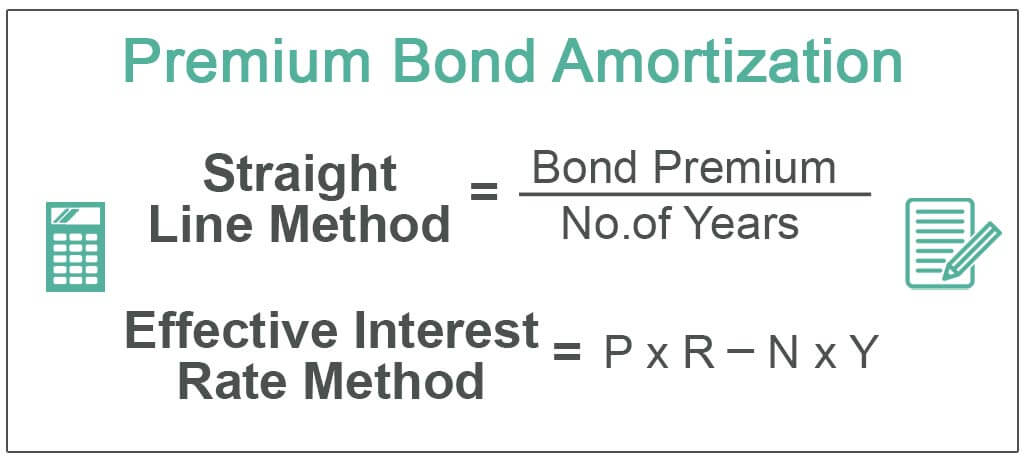

Bond Premium With Straight Line Amortization Accountingcoach

Amortizing Bond Premium Using The Effective Interest Rate Method Accountingcoach

What Is A Straight Life Policy Bankrate

How To Easily Calculate Straight Line Depreciation In Excel Exceldatapro Straight Lines Excel Line

Straight Line Depreciation Formula Guide To Calculate Depreciation

Coverwallet Looks To Make It Easy For Businesses To Get Commercial Insurance Commercial Insurance Liability Quotes Tech Startups

Business Valuation Veristrat Infographic Business Valuation Business Infographic

Rain Water Navy In 2022 Thibaut Navy Wallpaper Construction Wallpaper

Straight Line Depreciation Calculator With Printable Schedule Best Money Saving Tips Family Money Advertising Costs

7 Apple Watch Tips For Runners New Apple Watch Apple Watch Old Watches

Amortization Of Bond Premium Step By Step Calculation With Examples

The Simplest And Most Commonly Used Method Straight Line Depreciation Is Calculated By Taking The Purchase Or Acquisitio Business Valuation Method Subtraction

Amortizing Bond Premium Using The Effective Interest Rate Method Accountingcoach

What Are The Difference Between Annual Straight Line Amortization Vs Effective Interest Amortization The Motley Fool

Methods Of Depreciation Learn Accounting Method Accounting And Finance

Pin By Lori Bushman On Finance Life Insurance Policy Medical Professionals Finance

Ashworth A02 Lesson 8 Exam Attempt 1 Answers Exam Lesson Mortgage Payoff

Healthcare Coverage Another Option Health Insurance Options Best Health Insurance Health Insurance

What Are The Difference Between Annual Straight Line Amortization Vs Effective Interest Amortization The Motley Fool